Having significant inherited wealth brings with it both freedoms and burdens, profoundly impacting various aspects of life. Freedoms can be in the form of financial security, opportunities, choice of lifestyle, and philanthropy. But often, people don’t recognize that significant wealth can also bring with it burdens in the form of intense pressure, identity challenges, guilt, and relationship strains. Relationship strain takes many forms, but the focus of this article is to provide you with a roadmap for navigating requests for loans from family, friends, and even acquaintances.

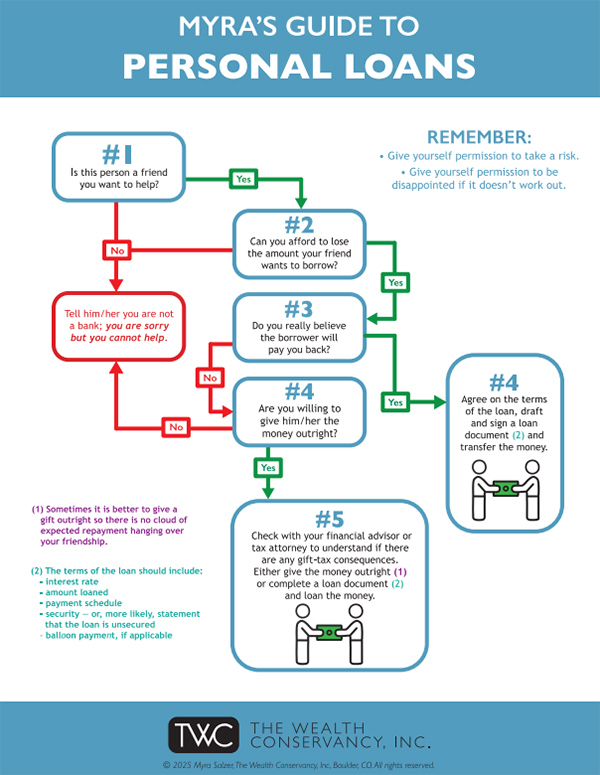

While sharing your financial resources to support another can be deeply rewarding, it’s crucial to approach the situation thoughtfully. In the course of TWC’s extensive history of providing wealth coaching, we see this issue so often that TWC’s Myra Salzer developed her own guide to help heirs consciously navigate the requests for personal loans (click/tap to enlarge):

Lending money to those close to you can complicate relationships and create tension if expectations aren’t clearly defined. When evaluating loan requests, consider the points outlined in the guide, including the borrower’s financial situation, their ability to repay (or possibly not), and how the loan aligns with your own financial goals, stability, and long-term plans. Open communication and setting clear terms can help navigate these sensitive situations while maintaining healthy personal connections.

If you’re a client of The Wealth Conservancy, please contact your advisor if you would like to discuss this or any other situation you’ve experienced as an inheritor for which you’d like guidance on navigating the turbulence of your inheritance. Oftentimes, our clients prefer for us to say “no” to the requester or for us to arrange for the loan and its ongoing accounting requirements.

Check out Myra’s video on loaning money to friends and our previous Blog post highlighting how apps like Zirtue can help you manage your relationships while managing your money.