How do we teach money management habits to the youth of today? It’s easier than you think!

Nowadays, it seems as though most kids have smartphones attached to their limbs. So, parents need to adapt how they think about teaching money-management habits to this tech savvy generation. Technology tools, specifically websites and smartphone apps, are making it super easy for parents to help incentivize kids to do their chores, to save, to spend wisely, and to learn how their money can grow. There are plenty of options available, but here are some of our favorites:

Regardless of whether you choose to use an app or just go about it the old-fashioned way, talking about money with kids early on will never be a bad thing. Having them learn the concept of income, expenses, and budgeting will go far with them. Financial literacy starts at home, and many kids miss out on that vital education due to the fact it is not emphasized in school. Take the initiative for them!

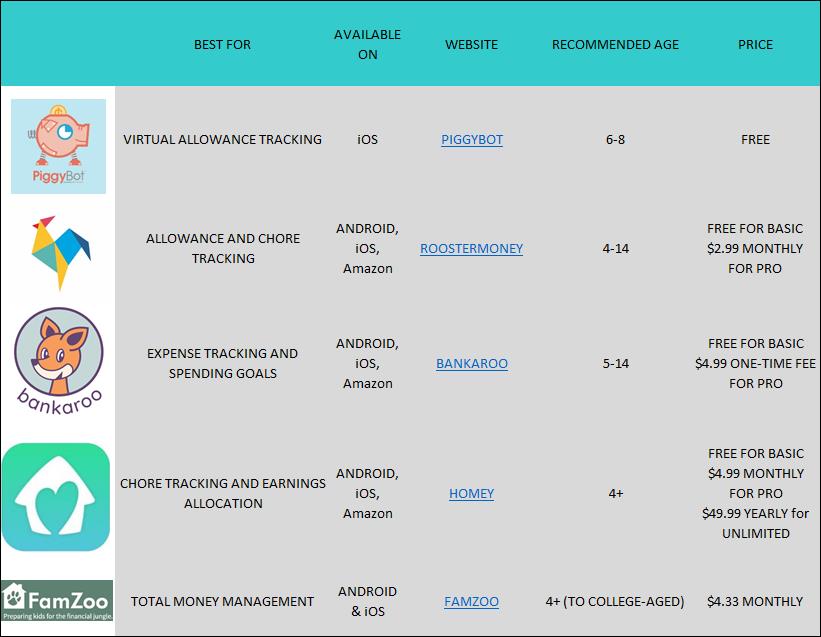

Piggybot is a virtual piggybank, and is very simplistic. The app helps parents and kids track a virtual balance instead of cash. There’s a bank account that parents can set up and “fund.” Then, kids can each track their earnings from allowance and use their money for three purposes: share, spend, and save. This is allocated based on an agreed upon percentage by the parents and kids. For each category, kids can post pictures of what they want to save for, and track their progress towards their goals! This is nice because in addition to teaching kids to save for things they want, it also teaches the importance of “sharing,” or “giving,” which could be to anyone: charity, family members, friends, and others.

Piggybot is a virtual piggybank, and is very simplistic. The app helps parents and kids track a virtual balance instead of cash. There’s a bank account that parents can set up and “fund.” Then, kids can each track their earnings from allowance and use their money for three purposes: share, spend, and save. This is allocated based on an agreed upon percentage by the parents and kids. For each category, kids can post pictures of what they want to save for, and track their progress towards their goals! This is nice because in addition to teaching kids to save for things they want, it also teaches the importance of “sharing,” or “giving,” which could be to anyone: charity, family members, friends, and others.

RoosterMoney is an allowance and chores app. It helps parents and kids manage “pocket money” for the family so that kids know exactly what they have available to spend, and parents can monitor their progress. Each user has his/her own individual account. For example, if everyone is out shopping, parents can easily deduct or add to their kids’ accounts so that the kids know what they have available to spend, showing the current balance in each of their “piggy banks.” Parents still handle the cash, but this is a great way for kids to know how much they can earn for different chores, make sure they get their allowances, use their money for savings goals or other expenses, and more.

RoosterMoney is an allowance and chores app. It helps parents and kids manage “pocket money” for the family so that kids know exactly what they have available to spend, and parents can monitor their progress. Each user has his/her own individual account. For example, if everyone is out shopping, parents can easily deduct or add to their kids’ accounts so that the kids know what they have available to spend, showing the current balance in each of their “piggy banks.” Parents still handle the cash, but this is a great way for kids to know how much they can earn for different chores, make sure they get their allowances, use their money for savings goals or other expenses, and more.

Bankaroo is a “virtual bank” app where kids can track their expenses and learn how they can pay for certain things that they want. For example, the kids set up the account and have their own “avatar,” which personalizes their experience. Once accounts are set up, kids can set spending goals and can also organize how they earn income. They can receive gifts or earn money through chores, in addition to receiving an allowance. They can allocate their earnings into savings or checking or charity. This is a great way for kids to have an interactive experience while learning fundamentals of money management.

Bankaroo is a “virtual bank” app where kids can track their expenses and learn how they can pay for certain things that they want. For example, the kids set up the account and have their own “avatar,” which personalizes their experience. Once accounts are set up, kids can set spending goals and can also organize how they earn income. They can receive gifts or earn money through chores, in addition to receiving an allowance. They can allocate their earnings into savings or checking or charity. This is a great way for kids to have an interactive experience while learning fundamentals of money management.

Homey virtualizes the chore chart in a household. It allows for organizing chores in a way where parents can assign tasks, and kids can mark them as “completed.” For example, parents can take pictures of chores or responsibilities that kids need to complete for either payment or as an expected task. Then, parents can demand photo-proof that the task was completed, before they fulfill payment. This helps to keep kids accountable. Also, kids can learn that by completing larger tasks or chores, they can earn more. It can be competitive, as the whole family gets involved and there are “failed” tasks. Primarily this app serves to teach kids the importance of income and earnings, and how to allocate their earnings. Kids can establish goals and then work to save for them.

Homey virtualizes the chore chart in a household. It allows for organizing chores in a way where parents can assign tasks, and kids can mark them as “completed.” For example, parents can take pictures of chores or responsibilities that kids need to complete for either payment or as an expected task. Then, parents can demand photo-proof that the task was completed, before they fulfill payment. This helps to keep kids accountable. Also, kids can learn that by completing larger tasks or chores, they can earn more. It can be competitive, as the whole family gets involved and there are “failed” tasks. Primarily this app serves to teach kids the importance of income and earnings, and how to allocate their earnings. Kids can establish goals and then work to save for them.

Famzoo is by far the most elaborate app in this comparison. It encompasses almost all of the functionality of the other apps above, in one. The parents are the “bank owners” and their kids are the customers. Each child has an account. There are two types of accounts – an IOU, and a prepaid card account. The IOU essentially tracks money that’s held in another institution (like a bank) and serves as a reporter of earnings/deposits and transfers. Also, parents can take money out of accounts when kids incur expenses for items they buy, or when they owe their parents. The prepaid card makes this app quite unique. It allows parents to load a set amount of money that the kids can allocate to savings or spending, and parents can increase the kids’ card balance based on chores and more. This helps kids learn the real concept of where money can go and how to make it last. The app categorizes and organizes all of these expenses, income, transfers, etc., so that parents and kids can have a full picture of their money flows.

Famzoo is by far the most elaborate app in this comparison. It encompasses almost all of the functionality of the other apps above, in one. The parents are the “bank owners” and their kids are the customers. Each child has an account. There are two types of accounts – an IOU, and a prepaid card account. The IOU essentially tracks money that’s held in another institution (like a bank) and serves as a reporter of earnings/deposits and transfers. Also, parents can take money out of accounts when kids incur expenses for items they buy, or when they owe their parents. The prepaid card makes this app quite unique. It allows parents to load a set amount of money that the kids can allocate to savings or spending, and parents can increase the kids’ card balance based on chores and more. This helps kids learn the real concept of where money can go and how to make it last. The app categorizes and organizes all of these expenses, income, transfers, etc., so that parents and kids can have a full picture of their money flows.