Review by Myra Salzer

Review by Myra Salzer

A few weeks ago, I happened on an Angelo Robles podcast in which Robles interviewed Jim Rickards, and, since TWC’s investment strategist Steve Henningsen has frequently quoted Rickards in his commentaries and updates, I thought it would be fun to hear him directly. Rickards did not disappoint! I found myself nodding my head often and wondering if I was experiencing confirmation bias at its best.

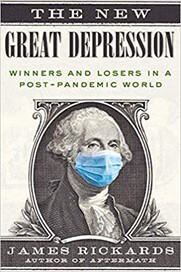

Next thing I knew, I was buying and actually reading Rickards’ latest book, The New Great Depression: Winners and Losers in a Post-Pandemic World. It just came out in January. Steve and Rickards must read the same sources, because their conclusions are very similar. Again, confirmation bias?

Rickards starts with the history of COVID and how different governments managed its spread. He pointed out how the lockdowns were not only ineffective but damaging, with us over-sanitizing and therefore killing some of our own immunities and our own economy in the process.

The Fed’s response was no surprise, and, on that topic, we’ve heard it (from Steve) many times before. Neither monetary policy nor fiscal policy amount to “stimulus.” Rickards, like Steve, believes we are headed for a dark period, and he – again like Steve – recommends a portfolio that can profit from the depression we are already experiencing and that will continue for some time.

Reading The New Great Depression: Winners and Losers in a Post-Pandemic World was not only interesting, it was informative and validating.

As an aside, though I’ve not subscribed to Angelo Robles’ podcast (he is the founder and president of the Family Office Association), I’ve been impressed with the quality of his guests and his content.