Budgeting, saving, investing, and shopping are as simple as they can be in 2020, thanks to some ingenious tools available to all. This is will be a two-part Blog post from TWC, with this first part focusing on the budgeting and banking aspect of the financial world. “Real Simple” magazine compiled a list of products and services that will boost your bottom line and may become an essential tool in your life, and we share that list here.

Budgeting, saving, investing, and shopping are as simple as they can be in 2020, thanks to some ingenious tools available to all. This is will be a two-part Blog post from TWC, with this first part focusing on the budgeting and banking aspect of the financial world. “Real Simple” magazine compiled a list of products and services that will boost your bottom line and may become an essential tool in your life, and we share that list here.

Budgeting

Cleo is a tool to spot bad habits. Connect your bank accounts to this app and it will scan your transactions and help answer questions like, “How much did I spend last month on takeout?” or, “Should I be spending more money on shoes?” Cleo helps to identify trouble areas in your spending, and assists with planning and maintaining a budget. Cleo offers two account tiers: a free account, and a $5.99 per month account called “Cleo Plus.”

Cleo is a tool to spot bad habits. Connect your bank accounts to this app and it will scan your transactions and help answer questions like, “How much did I spend last month on takeout?” or, “Should I be spending more money on shoes?” Cleo helps to identify trouble areas in your spending, and assists with planning and maintaining a budget. Cleo offers two account tiers: a free account, and a $5.99 per month account called “Cleo Plus.”

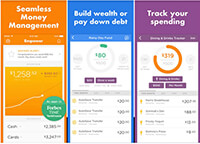

Clarity Money is an app that shows you which companies receive most of your money (is it Amazon? Whole Foods? Apple?), and it will alert you if your account balance is getting low. Clarity Money is a great tool to manage subscription services and spot forgotten recurring charges. Making it even easier, Clarity Money will supply you with the phone number to call to cancel any unwanted services. You can even have the option to funnel any saved money into a high-yield savings account under the online bank, Marcus. The app is completely free to use, but Clarity Money will charge you a one-time fee equal to 33% of the annual savings you receive from their bill negotiation service.

Clarity Money is an app that shows you which companies receive most of your money (is it Amazon? Whole Foods? Apple?), and it will alert you if your account balance is getting low. Clarity Money is a great tool to manage subscription services and spot forgotten recurring charges. Making it even easier, Clarity Money will supply you with the phone number to call to cancel any unwanted services. You can even have the option to funnel any saved money into a high-yield savings account under the online bank, Marcus. The app is completely free to use, but Clarity Money will charge you a one-time fee equal to 33% of the annual savings you receive from their bill negotiation service.

Zeta is an app for couples that tracks joint bills and creates budgets that’ll help propel you towards your shared goals. You don’t even need to have a shared bank account; the IOU system simplifies splitting bills and tallying expenses. Zeta allows both users to be on the same page financially. This free app can be used for everything, from large purchases like a home to paying routine bills.

Zeta is an app for couples that tracks joint bills and creates budgets that’ll help propel you towards your shared goals. You don’t even need to have a shared bank account; the IOU system simplifies splitting bills and tallying expenses. Zeta allows both users to be on the same page financially. This free app can be used for everything, from large purchases like a home to paying routine bills.

Banking

SoFi Money Vaults are customizable subaccounts that you can use for special goals, such as rainy-day funds, home renovations, or backyard landscaping. You’re able to watch the balances in each subaccount on the same dashboard, and there are no fees or minimum-balance requirements. These money vaults allow you to separate money into buckets, which encourages you to save more. There are no account fees and no account minimums. There is no monthly maintenance fee, no non-sufficient funds fee, and no overdraft fees. You can get personal checks for free, as well as bill pay and transfers.

SoFi Money Vaults are customizable subaccounts that you can use for special goals, such as rainy-day funds, home renovations, or backyard landscaping. You’re able to watch the balances in each subaccount on the same dashboard, and there are no fees or minimum-balance requirements. These money vaults allow you to separate money into buckets, which encourages you to save more. There are no account fees and no account minimums. There is no monthly maintenance fee, no non-sufficient funds fee, and no overdraft fees. You can get personal checks for free, as well as bill pay and transfers.

Empower is an app that, once a week, detects any excess cash in your checking account and sets it aside as savings. The app acts as a tool to analyze patterns and help you stash away money that is just sitting in your checking account. There are no balance minimums, no overdraft fees, and you have unlimited withdrawals. Empower is free for the first 30 days, then $8 per month to continue accessing all of the money management features in the app.

Empower is an app that, once a week, detects any excess cash in your checking account and sets it aside as savings. The app acts as a tool to analyze patterns and help you stash away money that is just sitting in your checking account. There are no balance minimums, no overdraft fees, and you have unlimited withdrawals. Empower is free for the first 30 days, then $8 per month to continue accessing all of the money management features in the app.

Level is a no-frills, all-digital bank (no bricks & mortar!) that launched in February, 2020. This bank offers generous interest rates for deposit accounts. Currently, the interest rate is 12 times the national average for interest-bearing checking accounts. This means that $5M in the bank would currently earn you $25,000 interest in a year. At Level, you can earn by spending, too: you receive 1% cash back on qualified purchases. The Level Bank app is free, but in order to get a complete picture of your finances by linking your bank accounts and credit cards, you have to pay for the “Every Dollar Plus” version of the app, which costs $99 a year.

Level is a no-frills, all-digital bank (no bricks & mortar!) that launched in February, 2020. This bank offers generous interest rates for deposit accounts. Currently, the interest rate is 12 times the national average for interest-bearing checking accounts. This means that $5M in the bank would currently earn you $25,000 interest in a year. At Level, you can earn by spending, too: you receive 1% cash back on qualified purchases. The Level Bank app is free, but in order to get a complete picture of your finances by linking your bank accounts and credit cards, you have to pay for the “Every Dollar Plus” version of the app, which costs $99 a year.