As a result of the rise of demand for financial and life coaching, it’s only reasonable that there has been a tremendous influx of financial-wellness apps. From budgeting, investments, and banking, to debt management and taxes, you name it… there’s an app for that. But how do you pick the right one? And will it work? The interesting conundrum is that simply downloading an app doesn’t seem to fix the problem of overspending. Even after using some of these tools, many people still seem to struggle with managing their cash flows.

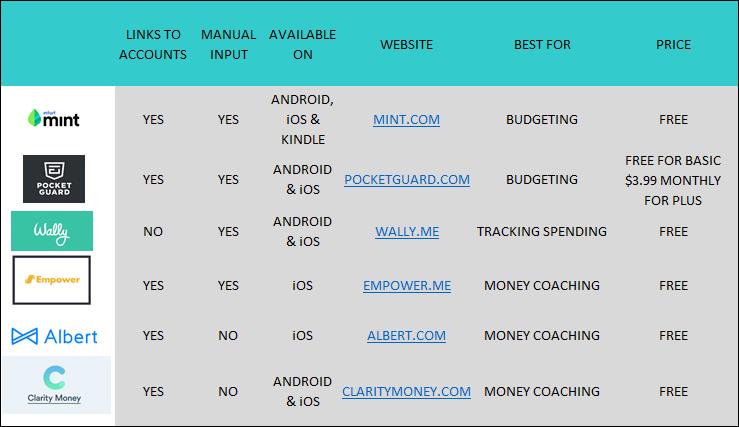

The great news is that there are solutions for each type of person. You owe it to yourself to figure out which one is the best for you! Seeing as it is highly unlikely that you will want to spend a ton of time researching different methods, we have done the work to help narrow down your options. So, whether you are saving up for a big trip, trying to cut back on frivolous spending, budgeting to pay down debt, or you just want transparency into your cash flows, some of these may be for you. Compare features with the table below and read further for details of each app.

There are so many great options to take control of your financial life. Take a spring-cleaning approach to your finances and try a couple of these solutions during the next couple of weeks. Have fun with it, and use your app once a day at the very least. Some food for thought when you’re thinking of giving up:

“You’ll never change your life until you change something you do daily. The secret of your success is found in your daily routine.” – John C. Maxwell

Try some of these free solutions on for size:

For those who really WANT to budget:

Mint was one of the first in the budgeting app arena. It’s a great tool for those of you who actively want to view your expenses, income, and net worth. It’s a great tool if you’re the type of person to keep Excel spreadsheets, or files on your accounts to track balances and spending. Mint enables you to connect all of your online financial accounts (banks, credit, mortgage, investments) so you can see everything at once and get a full picture.

Then, Mint makes it super easy to create budget categories and goals for each category, so you know you can stay on budget for specific areas. Mint is owned by Intuit and they have tremendous customer support, and the app/online tools are very easy to use.

Great for: people who want to see how they’re doing with their overall net worth, and what they’re spending money on.

The question Pocketguard aims to answer is, “if you were to look into your wallet, what would you find?” The app focuses a lot on “cash in hand,” and it aims to help you realize what you have available to spend for the day, week, and month, and can even help you plan for future expenses. It’s really simple to use. It mainly gives you an idea of what you have now, and what you have left to spend, given your income and expenses. It’s helps people who overspend manage their spending, because it implements spending limits on specific categories, to help people stay in front of their cash flows. The one caveat is that it does tend to benefit those with fairly simple financial situations, as it really focuses on bank and other cash accounts.

Great for: people who want to know how much they can spend now and, in the future.

Wally is a true spending tracker app that focuses on organizing your income and expenses. The app makes the art of tracking spending more pleasing to the eye, and more fun. Users do have to input things manually, but the app enables you to keep track of all details of your spending, what you spent, where you were, why you spent it, and more. The way it categorizes expenses can be unique to the user. For example, you can have categories such as “location,” “friends,” or “spending type.” It’s usually is used in conjunction with another app, like Mint or Pocketguard. But it certainly does keep things simple and organized.

Great for: people who benefit from physically writing things down and who will remember to log all of their expenses.

For those who hate thinking about budgeting, but know they need a nudge in the right direction:

Empower is much more of a coaching app than a simple budgeting tool. It alerts you to ways you can save more, and it can help look for better deals for bills and other subscriptions or services you have. Since it sends alerts to you directly via text or email, you don’t have to proactively go into the app to get actionable insights. This app does track spending as well, and has an excellent budgeting feature. Empower is unique, as it has a banking aspect, where users can auto-save into savings accounts, to make sure they’re allocating funds to their financial goals. The app makes all of this super easy because you can link all accounts in one place and see transactions to get a very good view of cash flows.

Great for: people who are needing more guidance than simply tracking their expenses, and for those who are interested in a “one stop shop” for their cash flow accounts

Albert is like a personal assistant for your money. It combines a budgeting app with smart alerts. The app will provide notifications for things that directly apply to you, such as: “your tax refund is in,” and “you have more money in the bank.” It’s a true ‘smart’ app, as it automatically knows to alert you about things like paying bills, negotiating prices for services, identifying areas to cut costs, and more. In addition to all of these free features, for a small fee ($6/month), users can access Genius. Through Genius, users can receive live personalized help on questions like, “Should I buy or lease a car?” or “Can I afford to go out tonight?” They can even receive more personalized plans.

Great for: people who want automation for their finances and cash flows, but an option to reach out to a human for more complex questions.

The Clarity Money app really does give you clarity around your cash. It allows you to create goals for spending and uses nice charts and graphs to give you a picture of how you’re doing. It even has inspirational quotes to keep the encouragement up! This app alerts you when you’re overspending and helps you to save more for future goals by linking directly to savings accounts. It goes the extra mile as well, as it can recommend ways to lower bills, cancel subscriptions, or negotiate expenses. Clarity Money makes it a priority to always remind users of their habits, to help hold them accountable, and to motivate better decision making.

Great for: people who don’t have time to dig into their finances and want a solution that will help them make smart decisions.